Nanotechnology has shifted from concept to clinical reality, powering liposomal drugs, mRNA vaccines, and advanced diagnostics. But with promise comes complexity: tiny changes in particle size or surface chemistry can reshape safety, reproducibility, and long-term performance. Regulators are adapting, but frameworks remain inconsistent across regions.

For innovators, regulatory navigation is now as critical as the science itself. Success depends on early engagement, rigorous nano-specific data, and regionally tailored strategies. Those who integrate regulatory foresight into R&D will be best positioned to capture the opportunities of this rapidly growing market.

Market Growth, Trends, and Forecasts

U.S. Regulatory Landscape

Unlike the EU or UK, the FDA has no separate nanomedicine category. Instead, it applies traditional drug, biologic, or device rules with heightened scrutiny of nanoscale properties.

Key FDA Guidance Documents:

These emphasize robust particle profiling—size distribution, surface charge, morphology—alongside batch reproducibility and nano-specific toxicology (think immune activation and uptake by the reticuloendothelial system).

The agency expects Sponsors to weave nano-relevant data into standard submissions (INDs, NDAs, BLAs).

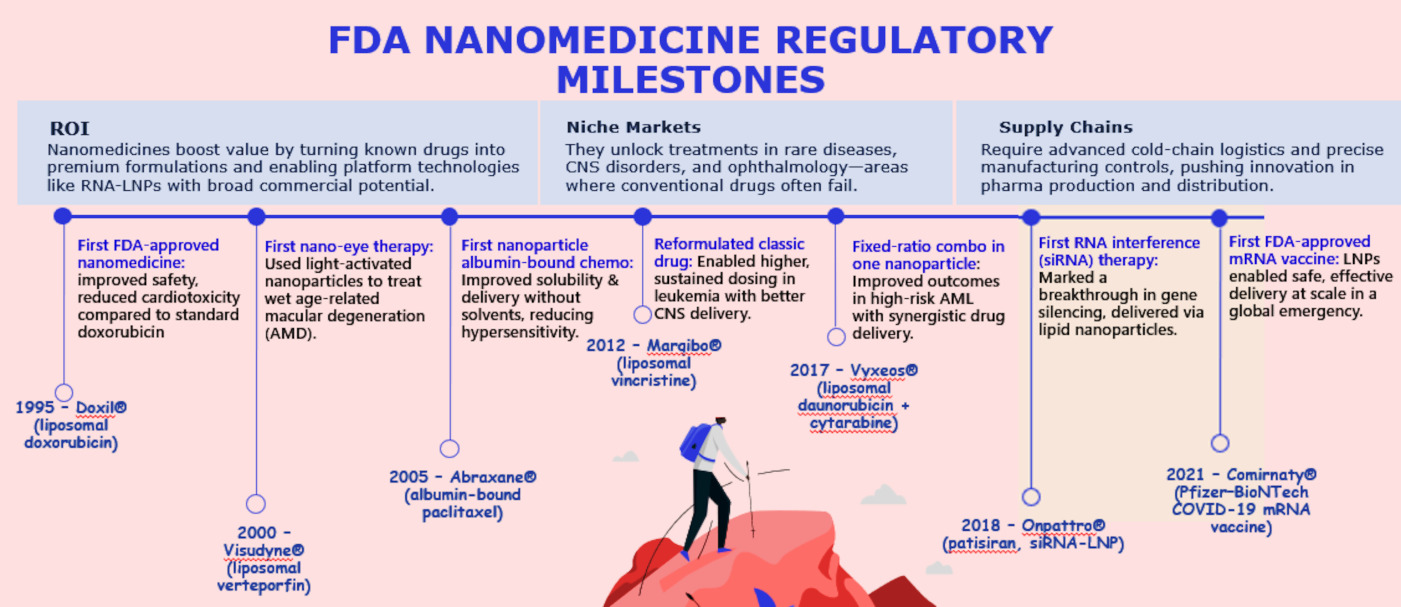

Milestones in U.S. FDA Nanomedicine Regulation

Key Regulatory Gaps in the U.S.

Global Regulatory Perspectives

- European Union (EMA): Reflection papers on liposomes, micelles, and iron colloids stress comparability studies and long-term safety. Onpattro® (patisiran) reflects this culture of rigor.

- Japan (PMDA): Offers guidance on liposomal drugs, with strong emphasis on chemistry, manufacturing, and control (CMC) data and early consultation.

- United Kingdom (MHRA): Rolled out a 2022 decision tree to classify nano-enabled products as drugs, devices, or combinations—mirroring its post-Brexit independence.

- Canada (Health Canada): Takes a flexible, case-by-case approach aligned with FDA and EMA.

- Australia (TGA): Follows EMA/FDA principles, encouraging dialogue and global harmonization.

- India (CDSCO): Issued nanopharmaceutical guidelines in 2019, though uneven enforcement persists.

- China (NMPA): Draft guidance (2021) covers nanoformulations, echoing its booming domestic pipeline.

Across regions, the common thread is case-by-case evaluation—nano only matters if it changes performance. But documentation detail, terminology, and demands for follow-on products still vary widely.

Regulatory Playbook for Innovators

The COVID-19 mRNA vaccines demonstrated that regulators can adapt quickly without lowering standards. The next wave—stimuli-responsive nanoparticles, multifunctional theranostics, and implantable nanosensors—will test regulatory agility even further.

Bottom Line: Nanomedicine’s growth potential is undeniable, but without a robust, proactive regulatory strategy, innovation risks delay. Developers that prioritize early dialogue, detailed characterization, and global alignment will be best positioned to deliver breakthrough therapies.