In an era where smartwatches track our heartbeats, fitness apps nudge us to move, and sleep trackers promise a better night’s rest, the line between wellness gadget and medical device is blurrier than ever. Is your Fitbit just a fitness tracker, or does it become a regulated medical tool the moment it claims to detect a health condition? For regulators, investors, and consumers alike, understanding this distinction is critical in a fast-growing, high-stakes market.

When is Wearable Health Tech Actually a Medical Device?

October 8, 2025

Wellness vs. Medical Device: The Regulatory Divide

The FDA’s stance is clear in principle: products that promote healthy lifestyles without making medical claims—step counters, hydration reminders, sleep scores—are treated as general wellness devices. They are low-risk and generally outside FDA oversight.

But once a product claims to diagnose, treat, or prevent a medical condition, it crosses into medical device territory. At that point, the bar rises: the device must comply with FDA quality standards, undergo clinical validation, and usually secure premarket clearance or approval. The dividing line isn’t the hardware—it’s the claims.

|

Feature / Criterion |

Wellness Device |

Medical Device |

|

Definition / Legal Basis |

Excluded from “device” if only for a healthy lifestyle and not for diagnosis/treatment. FDA applies enforcement discretion. |

Defined as products intended for diagnosis, treatment, mitigation, prevention of disease, or affecting body structure/function (includes SaMD). |

|

Intended Use / Claims |

General wellness tracking features. No disease claims. May include “risk reduction” or “living well with” if widely accepted. |

Diagnosis, treatment, prevention, or monitoring of disease. Intended use must be clear in labelling. |

|

Risk Profile |

Low risk: non-invasive, minimal harm. Higher risk may lose wellness status. |

Risk-based classification: Class I (low), II (moderate), III (high). |

|

Regulatory Oversight |

Not subject to full FDA device regulations. Must avoid false/misleading claims. |

Must comply with registration, listing, premarket submission (510(k)/PMA), QSR, labelling, MDR, and recalls. |

|

Premarket Submission |

Not required if limited to wellness. Required if medical claims are made. |

Required: 510(k) for Class II, PMA for Class III (some Class I exempt). |

|

Labelling / Claims |

General wellness only; no diagnostic or therapeutic claims. |

Detailed labelling with intended use, warnings, and contraindications. Claims must be evidence-based. |

|

Quality Systems |

QSR not required under discretion; good practice to maintain controls. |

Must follow QSR/GMP: design controls, validation, risk management. Subject to FDA inspections. |

|

Post-Market |

Minimal FDA oversight: consumer protection laws still apply. |

MDR reporting, surveillance, recalls, and labelling updates. |

|

Registration & Listing |

Not required if wellness only. Required if medical claims are made. |

Required for all medical devices. |

Market Dynamics: Why This Distinction Matters

- The global wearable technology market is witnessing rapid expansion, valued at $84.2 billion in 2024 and projected to reach $186.14 billion by 2030, with a CAGR of 6% (2025–2030).

- Market growth is driven by increasing consumer adoption of smartwatches, fitness trackers, and health-monitoring devices. The integration of AI is enhancing wearables with real-time insights and personalized health recommendations.

- In the U.S., the market size rose from $19.92 billion in 2023 to an estimated $23.07 billion in 2024, with forecasts ranging between $47.5 billion and $132.2 billion by 2030.

- S. demand is fuelled by heightened health awareness, the popularity of smart rings and health devices, and innovations like smart glasses.

- Overall, both globally and in the U.S., wearables are transforming from simple gadgets into sophisticated tools for health, fitness, and connectivity, positioning the market for continued strong growth over the next decade.

Case Study: Fitbit’s Journey to the Medical Device World

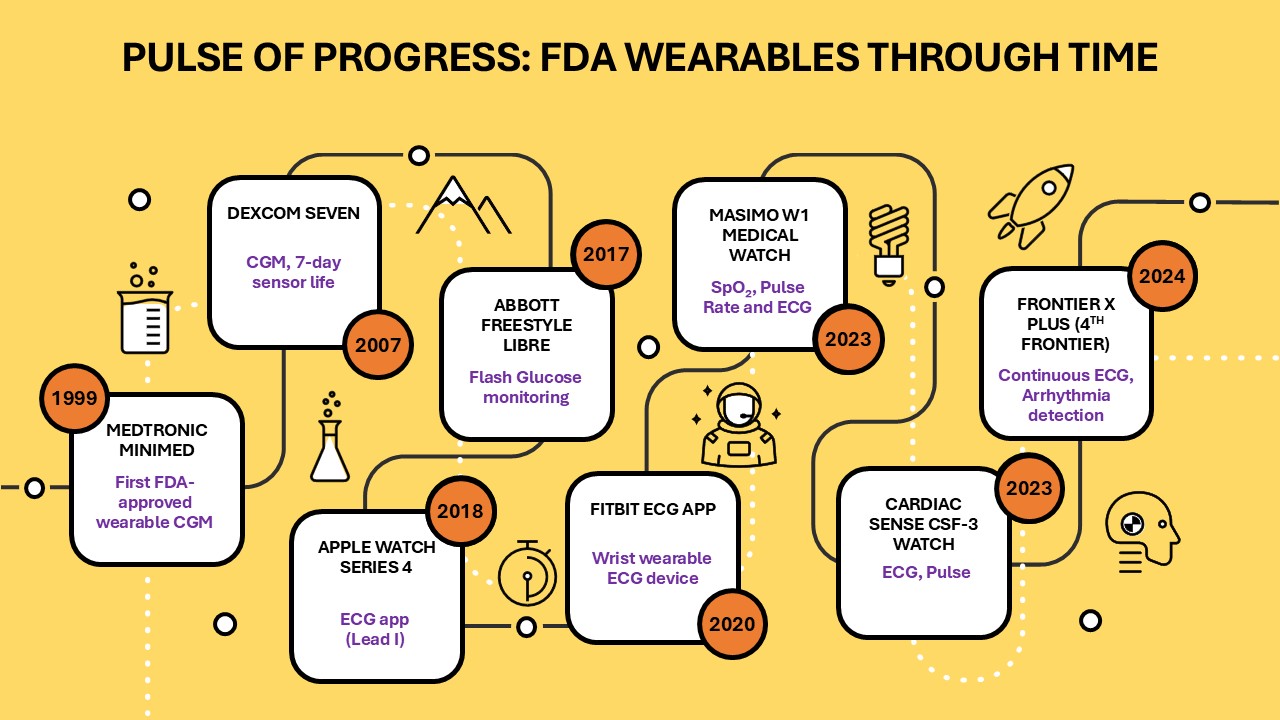

Fitbit began firmly in the wellness space: step counters, sleep trackers, and heart-rate monitors designed to promote healthy habits. The turning point came with the Fitbit ECG App, which promised to detect atrial fibrillation (AFib)—a potentially life-threatening condition. With that claim, Fitbit moved from fitness into regulated healthcare.

To launch the ECG feature, Fitbit submitted a 510(k) premarket notification, citing the Apple ECG App (De Novo DEN180044, 2018) as its predicate. Both apps run on smartwatches, record single-lead ECGs via finger–wrist electrodes, detect rhythm irregularities like AFib, and deliver results in real time. By showing substantial equivalence to Apple’s app, Fitbit avoided a full De Novo submission.

Key takeaway: Fitbit’s strategic shift was not merely about innovation—it was a calculated move to tap into a burgeoning market. As the wearable medical devices sector accelerates, clinical-grade devices command higher prices, unlock reimbursement opportunities, and facilitate partnerships with healthcare providers and insurers.

Global Regulatory Perspectives: Beyond the FDA

While FDA standards shape U.S. market entry, global expansion requires navigating distinct—and often stricter—frameworks:

|

Region |

Health Authority |

Key Insights |

|

|

European Medicines Agency (MDR 2017/745) |

Exceeds FDA requirements with tougher clinical evidence, transparency mandates, and post-market surveillance. Approval delays are common due to a shortage of notified bodies. |

|

|

Medicines and Healthcare products Regulatory Agency (MHRA) |

Post-Brexit, the UK is phasing in UKCA marking. CE marking remains accepted for now, but dual compliance may soon be required. |

|

|

Health Canada – Medical Devices Bureau (MDB) |

Uses a four-tier risk system (Classes I–IV). Most wearables with clinical claims fall into Class II or III. |

|

|

National Medical Products Administration (NMPA) |

Often requires local clinical trials for wearables with diagnostic claims, leading to longer approval timelines than the FDA. |

|

|

Pharmaceuticals and Medical Devices Agency (PMDA) |

Aligns broadly with FDA and IMDRF principles but demands unique submission formats and review processes. |

|

|

Central Drugs Standard Control Organization (CDSCO) |

The 2017 Medical Device Rules created a still-evolving framework. Oversight is tightening as the system matures. |

|

|

International Medical Device Regulators Forum (IMDRF) and World Health Organization (WHO) |

International convergence efforts continue, especially for SaMD, but practical differences from FDA standards remain significant. |

Bottom line: FDA clearance rarely guarantees global approval. Each market adds its own evidence, documentation, or compliance hurdles—requiring region-specific regulatory strategies and often staged rollouts.

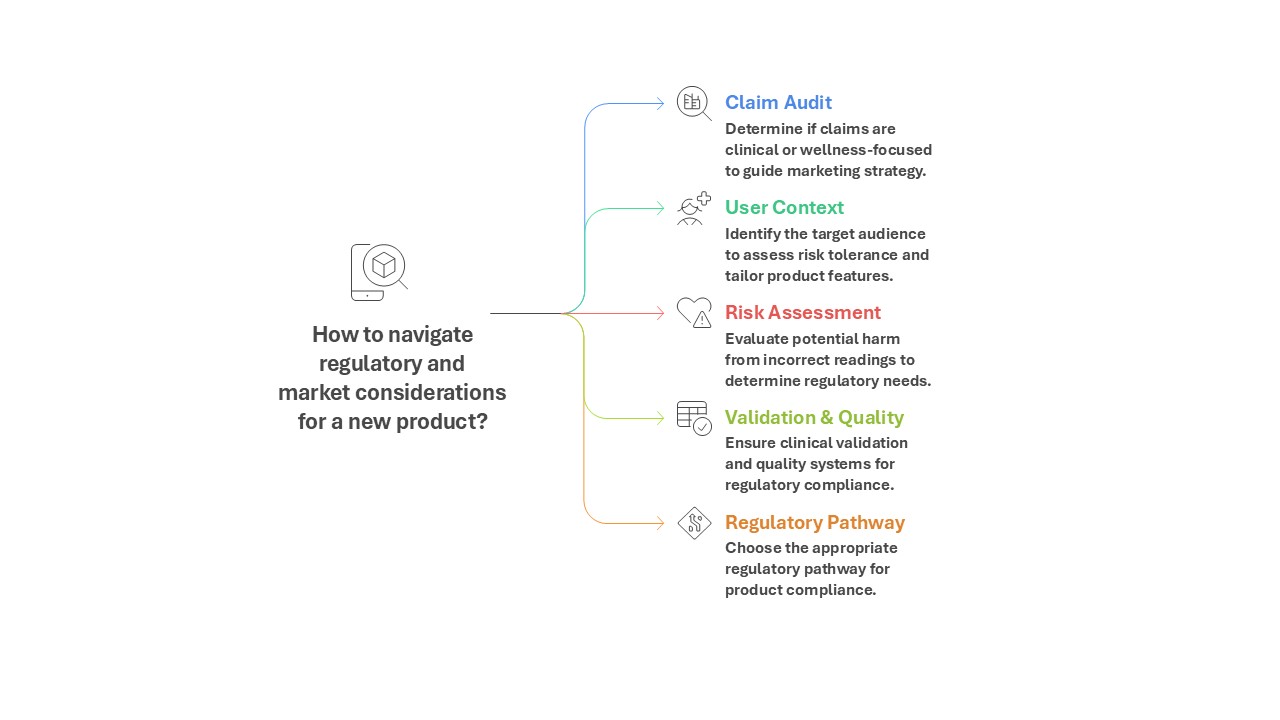

Strategic Pathways for Developers

To navigate this complex landscape, many companies take a hybrid path: releasing wellness features quickly, then validating specific clinical modules for regulatory approval. This “dual-track” strategy mirrors Fitbit’s journey, balancing speed-to-market with the rigor required for clinical credibility.

Looking Forward

The boundary between lifestyle and clinical claims continues to evolve. Regulators are taking a risk-based approach, focusing on features that could cause harm if inaccurate, while allowing low-risk wellness features to flourish.

For companies, the decision to make a clinical claim is both strategic and financial. Clinical validation opens doors to healthcare markets and higher-value customers—but comes with regulatory obligations and costs. As remote monitoring and preventive care become mainstream, the commercial and public health incentives for clinical-grade wearables are only increasing.

References

- FDA. General Wellness: Policy for Low-Risk Devices. fda.gov

- Fitbit ECG App 510(k) Premarket Notification. FDA Access Data

- Grand View Research. Wearable Technology Market Size | Industry Report, 2030. grandviewresearch.com

- Fortune Business Insights. Wearable Medical Devices Market Size | Forecast Report [2032]. fortunebusinessinsights.com