Misclassified Medical Device? How FDA 513(g) Saves Months!

December 24, 2025

As of 2024, the U.S. medical device market is estimated to be approximately USD 256.2 billion and is forecasted to grow at a compound annual growth rate (CAGR) of 5.9% over the period 2025–2030. For MedTech startups, FDA compliance isn’t just a checkbox—it’s a global regulatory benchmark and competitive edge.

Early engagement via a 513(g) Request for Information can clarify whether your product is a medical device, its likely class (I, II, or III), and the applicable regulatory pathway. The stakes are significant: misclassification can cascade into millions of dollars in wasted development costs, multi-year delays, and investor confidence erosion. This newsletter serves as your practical guide to 513(g), offering best practices, regulatory strategy tips, and real-world case studies.

What is a 513(g) Request?

Under Section 513(g) of the Federal Food, Drug, and Cosmetic Act, medical device manufacturers can formally ask the FDA:

- Device Definition: Does my product meet the definition of a medical device?

- Classification: If yes, what class does it fall under?

- Regulatory Pathways: Which regulatory pathway applies (510(k), PMA, De Novo, or exemption)?

FDA responds within 60 days with a written, non-binding opinion on classification and requirements. This is informational only—not marketing clearance—but it provides critical direction for development and compliance.

Why Early Engagement Matters for Startups

Startups often innovate in areas without clear predicate devices, making regulatory classification ambiguous. Missteps at this stage can create cascading challenges across development, clinical planning, and funding. The pathway your device is classified into directly determines development costs and timeline.

Device Classification Insights: Cost, Risk, and Approval

|

Aspect |

Class I (Often 510(k)-Exempt) |

Class II/ 510(k) |

Class III/ PMA |

|

Regulatory Risk Level |

Low |

Moderate |

High |

|

Typical Evidence Expectations |

General controls; limited testing |

Bench testing ± clinical data (case-dependent) |

Extensive nonclinical and clinical evidence |

|

Indicative Development Cost Range* |

~$100K–$1M+ |

~$2M–$30M |

~$10M–$100M+ |

|

Indicative Total Time to Market |

~6–18 months |

~18–48 months |

~36–84+ months |

|

FDA Review Type |

Often exempt from premarket review |

Premarket notification (510(k)) |

Premarket approval (PMA) |

|

Clinical Studies |

Rare |

Sometimes required |

Usually required |

*Ranges vary widely depending on device complexity

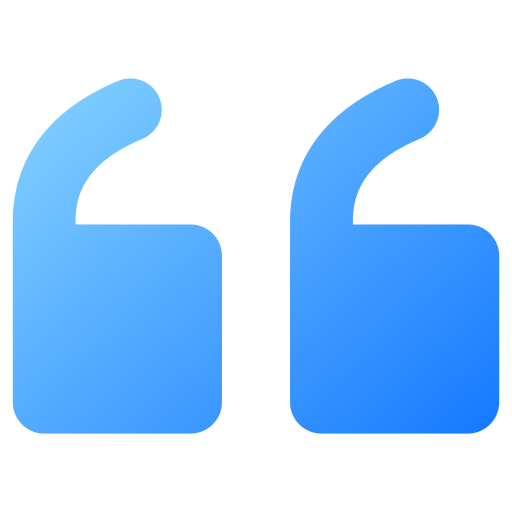

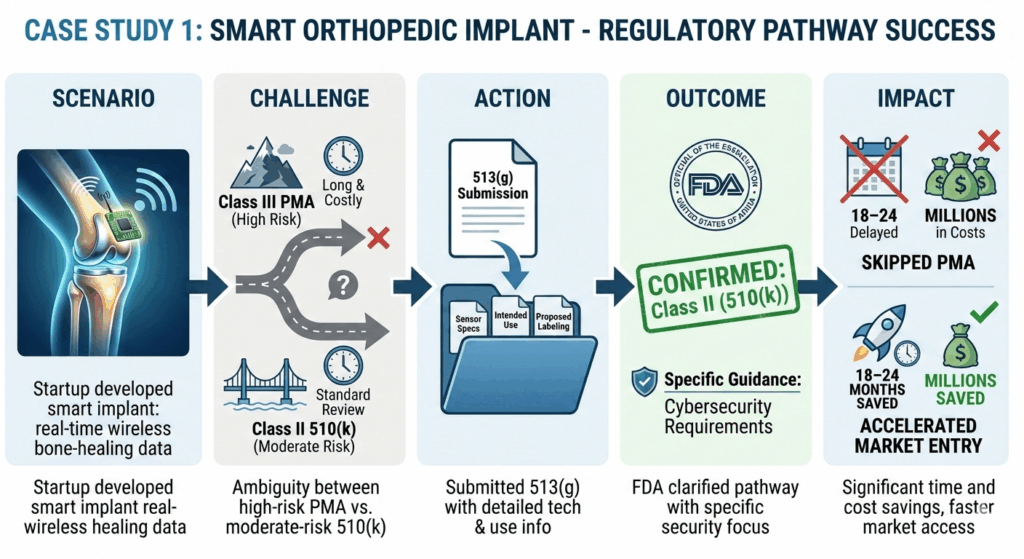

Below are examples of real-world consequences:

- Preparing the wrong submission – A startup builds an AI diagnostic app for rare eye diseases, assuming it could get FDA clearance through a 510(k) by comparing it to existing software devices. FDA determines that it is novel enough to require a De Novo submission, forcing the team to redo documentation and testing—delaying launch by months.

- Delays in clinical planning and fundraising – A startup developing a next-gen wearable glucose monitor assumes it’s Class I exempt and plans a small feasibility study. FDA classifies it as Class II, requiring formal clinical data, forcing a revised study design, higher budgets, and delayed fundraising timelines.

- Increased regulatory risk – A startup markets a mental health app as a wellness tool to avoid submissions. The FDA later classifies it as a medical device due to its claims, exposing the company to warning letters, product holds, and forced redesigns.

Such hiccups can be easily avoided through a formal 513(g) request to the FDA, which offers early clarity, enabling accurate budgeting and timeline, informed investor discussions, and strategic go-to-market planning. Submit one if no clear predicate (an existing FDA-approved device used as a reference to demonstrate that a new device is substantially equivalent for regulatory clearance) exists for comparison, or before committing to costly testing or clinical trials. It’s also wise to use 513(g) early to avoid expensive redesigns or delays, ensuring your development strategy aligns with FDA expectations from the start.

If you need feedback on testing protocols or clinical study design, consider a Pre-Submission (Q-Sub) instead.

Key Components of a 513(g) Submission

- Cover Letter: Identify as 513(g) Request for Information. Include the company, the date of the request, the name of the device, and specific classification questions and/or the regulatory requirements applicable to a device.

- Device Description: Design, components, materials, principle of operation. Include diagrams or photos.

- Device Use: the disease or condition with respect to which the device is to be used, prescription versus over-the-counter use, frequency of use, and patient population.

- Labeling: Proposed labeling and promotional materials. Include labeling of similar marketed devices if available. If no proposed or comparable materials are available, this should be noted in the cover letter.

Fees for a 513 (g) request and Submission Methods

- The standard fee for 513(g) request to FDA for the financial year 2026 is $7,820, and for the small business (For businesses certified by the Center for Devices and Radiological Health (CDRH) as a small business), it is $3,910.

- A 513(g) Request should be clearly identified as such. While electronic submission is not required, the

- \FDA recommends submitting as an eCopy or using the voluntary eSTAR template. Alternatively, a single complete paper copy may be submitted.

- Once a 513(g) Request and user fee have been submitted, new questions, uses, or technologies cannot be added.

Insights from the MedTech Guru

Q1: What’s the difference between a 513(g) and a Pre-Submission (Q-Sub)?

A: A 513(g) clarifies whether your product is a medical device and the applicable pathway. A Q-Sub provides interactive feedback on testing protocols, clinical study design, and manufacturing questions, and includes an in-person or virtual meeting with the FDA. Use 513(g) for classification ambiguity; use Q-Sub for technical guidance once classification is clear.

Q2: Does submitting a 513(g) guarantee FDA clearance?

A: No. A 513(g) provides informational, non-binding guidance on device classification and regulatory pathway. It does not constitute marketing authorization. You will still need to submit the appropriate premarket application (510(k), PMA, or De Novo) to obtain clearance/approval.

Q3: Can I modify my 513(g) after submission?

A: No. Any new questions, uses, or technologies must be submitted as a new 513(g) request, requiring a separate user fee and resulting in a separate FDA response.

Q4: What’s the typical response time from the FDA?

A: While the FDA is required to respond within 60 days, historical performance data (FY 2023) shows that only 25% met this goal. Budget 90–150 calendar days for response receipt. Many companies receive responses in the 55–60-day range when submissions are complete.

Upcoming Events

- JPM Healthcare Conference. Jan 12–15, 2026. San Francisco City Center San Francisco, California, United States. https://www.jpmorgan.com/about-us/events-conferences/health-care-conference

- AI Vizionaries Summit: How AI is reshaping the Point of Care. 27 Jan 2026. Jersey City, New Jersey, United States. AI Vizionaries Summit: How AI is reshaping the Point of Care

- 14th Annual Outsourcing in Clinical Trials: Medical Devices Europe 2026. 27 – 28 January 2026. Holiday Inn Munich City Centre, Munich, Germany. 14th Annual Outsourcing in Clinical Trials: Medical Devices Europe 2026 – Arena International

- IMCAS World Congress. Jan 29–31, 2026. Palais des Congrès de Paris 2 Place de la Porte Maillot, 75017 Paris, Paris, France. https://www.imcas.com/en/imcas-world-congress-2026

Resource Corner

About us

BLA Regulatory, LLC., operates as a global regulatory consulting firm specializing in medical devices and biopharmaceutical compliance and submission support. With deep experience in U.S. FDA pathways—including IND, NDA, BLA, 510(k), PMA, De Novo, and Breakthrough Device designations—the firm supports sponsors, startups, and manufacturers through the full product lifecycle: from strategic regulatory planning and gap analysis to preparation of meeting materials, agency interaction, and hands-on submission services. BLA Regulatory serves clients across the U.S., Europe, China, and Japan, and —helping bring safe and effective innovations to market with speed and reliability. For more insights visit: https://bla-regulatory.com/

Stay in Orbit

Subscribe to future issues of MedTech Orbit for practical updates, U.S. FDA device regulations, and smarter compliance strategies— delivered straight to your inbox.